When it comes to simple retirement planning, Betterment has you covered. College students can enjoy four years free, so sign up while you can! For everyone else, Acorns offers one of the most competitive automated investing services at a great price. This app comes packed with articles and videos made by financial experts in order to teach you about investing.

As a bonus, certain brands you invest in will pay you back in shares whenever you purchase their items. Acorns also offers investing into an IRA and setting up a checking account that saves a small portion of every purchase you make. For $1 a month, Acorns will manage your investments of amounts as low as a few dollars. What makes Acorns unique is the app’s simplicity and transparency. Acorns works like many other finance apps by “rounding up” transactions to the next dollar for savings. Most millennials avoid investing in the stock market due to a lack of knowledge, experience, and cash.

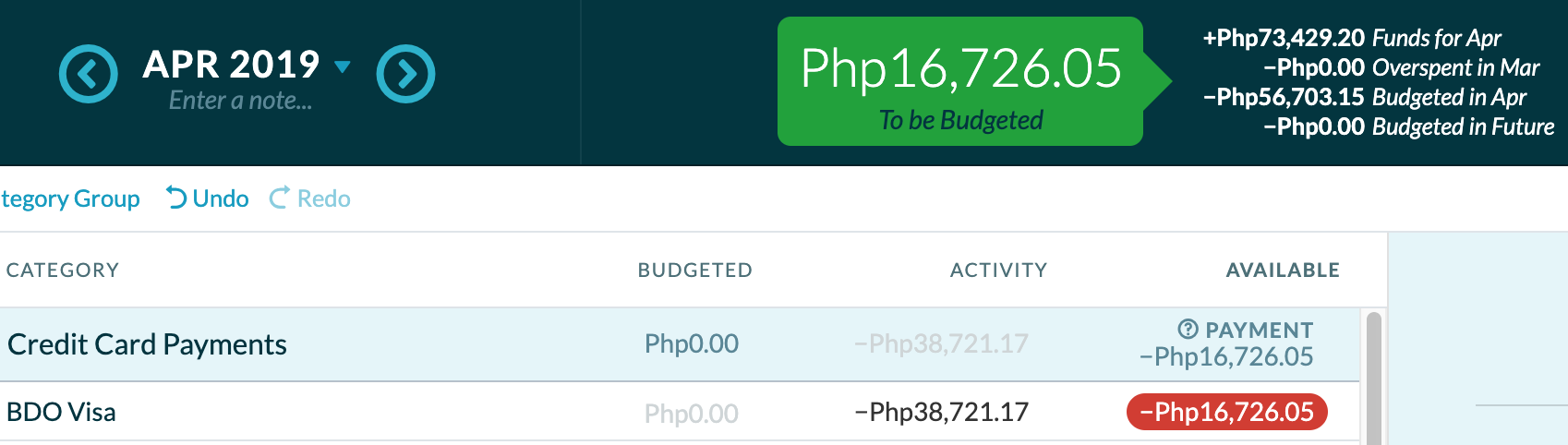

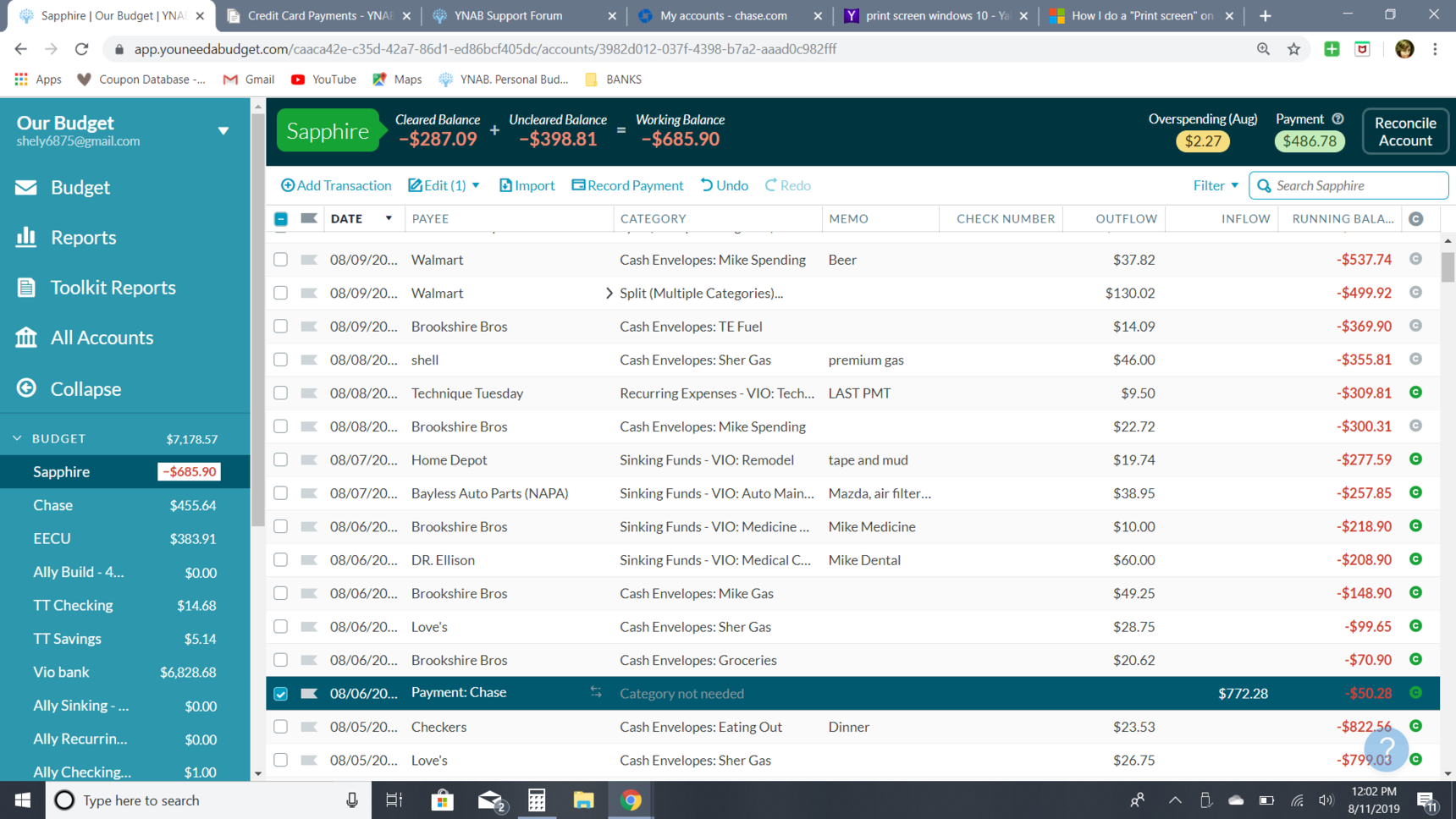

Adding a credit card refund ynab 4 free#

Digit has no account minimum and will even reimburse you if they cause an overdraft! If your budget is tight but you want to put away a little extra, then take advantage of the 30-day free trial. Although you don’t earn interest, you are rewarded with saving bonuses for money you would’ve spent anyways. This app will track your monthly income and expenses, and pin down how much extra cash you can afford to save. Digit is my choice for simplified savings, as it automatically saves your money in small increments based on what you can afford to put away that day. Traditional smart savors will put away large chunks of extra income on a regular basis into a high yield savings account, but a tight budget makes this method impossible. Having credit available to you on a credit card is not a reliable option for a “rainy day” as these accounts can be reduced and closed at the bank’s discretion. Unfortunately, the reality is that many Americans are living paycheck to paycheck with an insufficient emergency fund. Making savings a priority is essential to financial freedom. This app is very user friendly and is certainly worth taking a few minutes to set up. My favorite feature about Mint is its comparative projection tool that lets you look at all your retirement accounts and shows you how prepared you are for retirement. By applying your own spending desires to Mint’s recommendations, you can spend your money how you want without going over budget.

Based on this overview, Mint will propose a budget for you that you can alter as you prefer.

Adding a credit card refund ynab 4 software#

The idea is to let the software pull recent transaction data from your bank accounts, credit cards, and mortgages to provide you with an overview of your finances. It is a free finance tool that takes information from all your bank accounts in order to help you budget effectively. Mint is the top budgeting app on the app store for a reason. Whatever your financial goals are, you can make them more easily attainable by taking advantage of the following apps. Managing your spending, savings, investing and retirement has never been easier. The best way to manage your finances is simplicity, and mobile technology has made our lives easier through innovative applications. There are hundreds of finance apps that people use for a variety of reasons.

0 kommentar(er)

0 kommentar(er)